Most people have the will to win, few have the will to prepare to win.

-Bobby Knight

In FPU, we teach that members should put retirement investments temporarily on hold while they get out of debt. Once they have a three to six month emergency fund, it is time to actively prepare for those golden years.

53% of Americans have less than $25,000 in retirement savings. 43% of those people are over 55. 30% believe that they only need $250,000 or less in total retirement savings.

Guessing Game

If you are of my generation, you probably can remember the concept of company’s having Pension funds. Those days are largely over, and many companies offer some type of Employee directed retirement plan, such as 401k or 403b.

Before taking FPU, I was simply enrolled in my company’s 401k. They offer a “match” of 1/2 up to 6% (e.g. 3%), which, as most of will say, means free money. I was given a prospectus of the various funds and was asked to distribute my contributions over the funds.

I had absolutely NO IDEA what I was choosing, so I just guessed.

FPU Members are given two classes on Investment: Of Mice and Mutual Funds (week 9) and From Tuition to Fruition (week 10). Between these two classes, we learn the differences between a Mutual Fund, a single stock, Growth Stock Mutual Funds, Roth Investments, IRA, 401k, 403b…whew! It’s enough to make your head spin.

If you want to know why you should take FPU, I point to these two classes (along with the Insurance class, Clause and Effect).

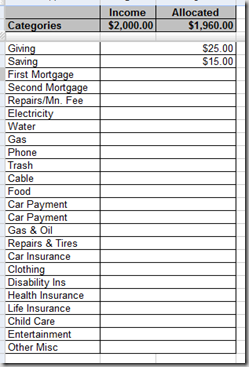

What We Did

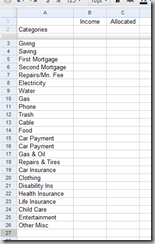

In January 2009, Cindy and I finished Baby Step 3 and were ready to begin our investments. We knew that 15% of our income would go towards this step. I restarted my 401k through work with a phone call to HR. I had them pull 6% our of each paycheck. Next, I contacted an Endorsed Local Provider (ELP) to begin investing in mutual funds that grow Tax Free (Roth IRA).

The Dave Ramsey ELP program is a certification program that the person who you go to operates the same way that Dave recommends. There are ELP for Investing, Real Estate, Tax Services…the list goes on.

We went to a Investing ELP, who set us up with American Funds. Every month, 9% of our income is automatically withdrawn and invested. Cindy and I were not charged a penny for this (well, directly, anyways, I am sure he gets something from American Funds). Once we had the accounts set up, I haven’t seen the ELP since.

How Much?

How much will you need to be able to retire with dignity? There is a simple formula that you can use, which I will explain. This formula comes directly from the FPU Workbook (page 142).

If you save at 12% and inflation is at 4%, then you are moving ahead of inflation at a net of 8% per year. If you invest your nest egg at retirement at 12% and want to break even with 4% inflation, you will be living on 8% income.

| Step 1 | |

| Annual Income (today) you wish to retire on: | $50,000 |

| Divide by .08 | |

| Nest Egg that will be needed: | $625,000 |

To achieve that nest egg, you will save at 12%, netting 8% after inflation. So,we will target that nest egg using 8%:

| Step 2 | |

| Nest Egg Needed | $625,000 |

| Multiply by factor | .000436 |

| Monthly Savings Needed | $272.5 |

The Factor in step two is the “8% Factor” that matches your age and years to save:

| Your Age | Years To Save | Factor |

| 25 | 40 | .000286 |

| 30 | 35 | .000436 |

| 35 | 30 | .000671 |

| 40 | 25 | .001051 |

| 45 | 20 | .001698 |

| 50 | 15 | .002890 |

| 55 | 10 | .005466 |

| 60 | 5 | .013610 |

Ready…Aim…Fire

I believe that the work book is good for giving you an Idea of what you will need, as opposed to being like 30% who believe some large number will do it for them. Run the formula again and change age brackets. See what happens if you wait? The Compound Interest Kung Fu will not be working for you.

For us, this formula was not as depressing as I thought. Rather, it gave us a goal. Once you finish the first three baby steps, the goals become less immediate, and more long term. I need to know that I am heading in the right direction.

How about you?